Many taxpayers would prefer to resolve back taxes by paying less than the full amount of tax, penalty, interest, and fees.

The Offer In Compromise (“OIC”) is a well-known Internal Revenue Service tax-relief program, sometimes advertised as the “pennies on the dollar” program. The OIC is also highly promoted by the tax resolution industry.

Hawaii has a Hawaii state version authorized by Hawaii Revised Statutes Section 231-3(10) and implemented by the Department of Taxation pursuant to Administrative Rule 18-231-3-10(a.)

This short note reviews statistics on Hawaii’s program and offers some comments on its usefulness.

I recently obtained information on accepted OICs from the Hawaii Department of Taxation pursuant to an Information Act-type request. Only accepted OICs are available for public inspection; rejected OICs are not publicly available.

The information publicly available about the accepted OICs is limited to: name of taxpayer, amount and type of tax, amount of penalties and interest, total liability, actual payments made, and reason for the compromise.

Again, no information is available for OICs that were not accepted.

2. Summary of Accepted OICs

For the period January 1, 2015 through December 31, 2020, the Department accepted a total of fifteen (15) OICs.

|

Year |

Accepted OICs |

|

2015 |

3 |

|

2016 |

1 |

|

2017 |

1 |

|

2018 |

2 |

|

2019 |

4 |

|

2020 |

4 |

|

15 |

The total amount owed (tax, penalties, interest less payments) for all fifteen accepted OICs was $848,765.64.

The total settlement amount was $57,250, or about 6.75% of the total amount owed.

For the fifteen (15) accepted OICs, the averages were:

Four (4) of the OICs had tax balances greater than $50,000. This is significant because a tax balance greater than $50,000 requires the approval of the Governor of the State of Hawaii.

Here’s a chart summarizing the OICs with reference to the $50,000 cap:

All accepted OICs were granted due to “doubt as to collectability.”

Tax types. Five (5) taxpayers were general excise (GE) only. Five (5) taxpayers were net income (income tax) only. Four (4) taxpayers were a combination of GE and Net Income, with a single taxpayer having GE, Net Income, and WH.

3. Observations

Limited Data. We only have data for accepted OICs. Therefore, we cannot draw meaningful conclusions as to the types of OICs that were rejected or the likely reasons for acceptance or rejection.

Aging of Delinquent Balances. We can infer from the ratio of tax and penalty to interest that, on average, the cases were at least seven (7) years old prior to acceptance. Put another way, the most recent balance owed was probably incurred at least seven (7) years prior to acceptance.

Penalty Imposition. While the data is limited, the penalty rate, meaning penalty/tax, is approximately 20.75%. As explained below, my assumption is that these cases were simply late filed returns.

Three taxpayers had no penalty imposed whatsoever, suggesting they had previously obtained relief from penalties, potentially due to “reasonable cause.”

In no case was any accepted OIC taxpayer penalized at a rate greater than 25%; meaning: no fraud and no “intentional or negligent disregard of rules” penalties had been imposed. 25% is the standard balance due, late filing penalty. Thus, the inference is that most of these situations were of tax returns simply filed late and without payment.

Amounts of Settlement. On average, the accepted OICs paid 6.75% of the total amount owed. The eleven (11) cases equal to or less than $50,000 in tax paid 8.2%, despite four (4) of those cases paying $300 or less. The four (4) cases with a tax balance greater than $50,000 paid 5.9%.

Frequency. Fifteen (15) OICs accepted in a six-year period for a total of approximately $800,000 compromised in that period suggests the Hawaii Offer in Compromise program is not a meaningful resolution alternative or option for most taxpayers.

As an idea, just for the fiscal year ending 06/30/2020, Hawaii DoTax reported a starting delinquent balance of $1,037B with $269.1M in new debt and approximately 68,269 tax collection cases. Source: 2020 Annual Report from DoTax website, p 7 of 88.

The dollars are too large to reasonably grasp, but a tiny number of taxpayers and a tiny amount of outstanding tax debt is resolved by this Hawaii OIC program.

Cost-Benefit. OICs are a major focus of tax resolution advertising. Taxpayers should certainly consider whether investing in professional services to prepare an OIC is cost effective in light of the chances for acceptance.

Taxpayers should also be aware than in addition to effort and time, potentially incurring professional fees, making partial payments (which may not be returned), an OIC proposal postpones (or “tolls”) the collection statute of limitations.

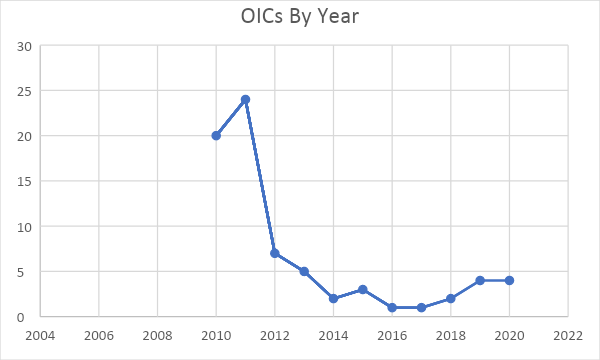

Trend. There might be a thought that 2019 and 2020 represent a trend in acceptances, with four acceptances each year. Here’s a ten-year chart:

IV. Conclusion

Systemically, since 2015, Hawaii’s OIC program cannot be considered a meaningful remedy for taxpayers with Hawaii tax debt.

Insofar as the characteristics that led to the particular fifteen (15) cases being accepted, those characteristics are not obvious from the data.

There are probably thousands of tax cases meeting the criteria of the average below-$50,000 case, that is, a total balance in the $28,500 range probably resulting from late-filed returns with approximately $12,000 in tax and $14,000 in interest (suggesting the balances are 10+ years old).

Due to the extremely limited number of accepted cases, it is difficult or impossible to determine whether a particular situation would be a meritorious candidate for an OIC proposal. I am not aware of any current published guidance (March 2021) from the DoTax on cases that would be particularly suitable for the OIC program in the Department’s view. Other aspects of Hawaii’s OIC program, some mentioned above, mean that a failed OIC probably puts the taxpayer in a worse position than before submission.

Tax professionals, and persons hiring tax professionals, should recognize the limited value of this program and consider alternatives for their back tax balances.