In 2018, Hawaii passed Act 41, an “economic nexus” tax law, to attempt to reach potentially taxable transactions. Hawaii’s new law was claimed to be modeled after the South Dakota law found to be constitutional by the Supreme Court in South Dakota v. Wayfair, Inc. (2018.) Economic nexus was enacted into tax law as Hawaii Revised Statutes Section HRS § 237-2.5.

Like South Dakota, but unlike most states, Hawaii has an excise tax, called the General Excise Tax (sometimes “GE” or “GET”), that reaches services, including professional services. Yes, Hawaii taxes services.

The tax is imposed upon the service provider but may be collected from the customer or recipient. As will be discussed below, this adds a substantial and unexpected dimension to the impact of Act 41, a dimension that may be unfamiliar to many service providers. Stated another way, Hawaii not only has an excise tax upon gross receipts but goes far beyond the mere sale of goods to reach the actual taxation of services.

Persons unfamiliar with Hawaii law and practices that are providing services to Hawaii businesses and consumers may unexpectedly find that they have “economic nexus” under the new standard, and are subject to the Hawaii General Excise Tax, a tax that reaches the gross receipts of the seller. This is a potential trap that can result in a 4.5% gross receipts liability plus penalties and interest.

This Article offers some thoughts. It is not legal advice.

Assumptions

Services vs. Sale of Goods. Implications of Act 41 are similar for the sale of goods, although I am discussing services. My potential comments may fit the sale of goods context differently.

Highest Rate Assumed. For simplicity purposes, there is an assumption the General Excise Tax’s regular “retail” rate of 4% applies. It is possible some service transactions could be at a different rate.

State-wide General Excise and County Surcharges. Hawaii’s state-wide “retail” GET is 4%. As noted above, the tax is imposed upon the seller’s gross income and is traditionally passed on and collected from the buyer at the time of sale. At the time of this writing, most of the counties (Hawaii, Kauai, Honolulu) have imposed an additional “county surcharge,” (initials “CS”), primarily at .5%.

Understanding How GE Tax Is Traditionally Passed On. It is traditional (and legal) to “recapture” (charge tax upon the tax) the general excise and county surcharge, resulting in the recapture rates of 4.16% (no surcharge) and 4.712% (with surcharge of .5%.) Stated another way, because the GE tax is upon the seller’s gross receipts, a seller passes on and collects enough to cover (or recapture), the tax upon the 4.5% tax. This is done by charging a higher rate.

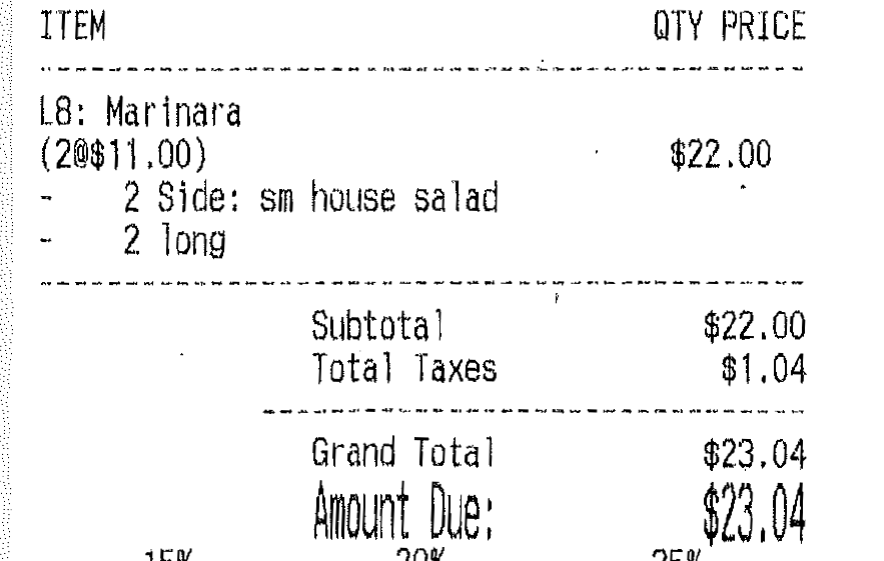

In Hawaii, GE/CS are typically a separate line item on receipts and invoices.

Note the passing on of the GET, 4.712%, rounded up to $1.04, on the receipt to the left.

Retroactivity. I also ignore some possible problems with Act 41 in terms of implementation and “retroactivity.” Act 41 was effective July 1, 2018, but purported to apply to taxable years beginning after December 31, 2017. The Department of Taxation stated that GE did not have to be remitted for the period January 1, 2018 to June 30, 2018 for taxpayers with nexus in 2017 or 2018. See, Announcement 2018-10, Page 3 of 7.

Initial economic nexus for a calendar year is triggered by crossing $100,000 in gross receipts or upon the 200th separate transaction.

Out-of-state service providers may find themselves liable for general excise tax after the services have already been rendered, invoiced, and payment remitted. This is because initial economic nexus may not be established until after the majority of services have been provided. This is a point in time probably too late to attempt to recapture the tax from the Hawaii customer. This is a huge trap for the unwary.

Remember Hawaii’s general excise a tax is imposed upon the seller, and, while traditionally collected from the buyer, this is not a legal requirement. It is not a sales tax.

Prior to Wayfair/Act 41, this was not a problem for an out-of-state service provider without physical nexus. Such a provider did not have to register for a general excise tax license and file and pay general excise tax. Instead, the Hawaii recipient of services (under most conditions) would have been responsible for and paid Use Tax on those imported services.

Assuming the out-of-state service provider is aware of HRS Section 237-2.5 and its new economic nexus requirements, how might the provider conduct its business with its Hawaii customers to prevent an expensive unwanted after-the-fact surprise?

This is a vast subject. In general, prior to South Dakota v. Wayfair, Inc., some level of actual physical presence was required. Physical presence meant an activity-related actual visit or actual presence in the state, including through an agent, employee, or sales representative. Physical presence, as outdated as the Supreme Court may have considered it in 2018, was a relatively bright line and, for the most part, easy to understand. Sending a sales representative on a sales call, or an installation/repair technician to the customer, is easy to understand (and possibly easy to avoid.)

If you have physical nexus, you are subject to the general excise tax and should seek appropriate guidance.

If you do not have physical nexus…

Act 41, now codified at Hawaii Revised Statutes Section 237-2.5, is applicable for economic nexus for taxable years after December 31, 2017, and sets out two alternative thresholds: $100,000 in annual gross receipts or 200 separate transactions. If either standard is met, economic nexus has been established and there is a filing (and payment) requirement for that year and the following calendar year.

A reminder here, if you get your estimate wrong, you may be liable for tax and unable, at that point, to re-capture the tax from your Hawaii customers. In other words, if your gross receipts exceed $100,000 or 200th transaction occurs in December…you probably will not be able to collect 4.712% (or possibly different county rates) from all your prior transactions. In practice, from your perspective, you will have given your prior Hawaii customers a 4%-4.5%+ discount.

If The Economic Nexus Threshold Is Certain To Be Met…

If either threshold is certain to be met, you should consider pre-emptively obtaining a general excise tax license from the Department of Taxation and collecting 4% general excise tax, plus the applicable county surcharge, on a “recapture” basis, on all transactions. “Recapture” refers to collecting the tax upon the tax, resulting in a 4.712% rate for Oahu (4% general excise plus .5% county surcharge, plus the 4.5% upon the 4.5% tax.) File and pay as appropriate.

Now The Hard Part: What if You Simply Cannot Predict In Advance?

#1 The first option might be to carefully limit your Hawaii services. Put another way, you would monitor your dealings, and simply forego business opportunities that would trigger economic nexus. (Legitimately) you would stop providing services below the $100,000 gross receipts annual threshold, decline to cross the 200th separate transaction.

#2 A second option might be to price your services with the possibility of the tax liability in mind. In other words, internal to your “Hawaii price” is a mark-up, which is not disclosed to the Hawaii customer. If you do not hit the threshold, well and good, if you hit the threshold, you are covered because you have collected the additional revenue.

In this context: Why not just add the taxes as a separate line item?

Why not simply add the Hawaii GE/CS as a line item? From an outsider’s perspective simply imposing the tax appears logical. This approach however may cause at least a couple of problems.

Initially, if you are dealing with consumers (as opposed to businesses), you might have a “consumer protection” or “fair business practices” problem if you do not ultimately pay over the tax.

With businesses, depending on your dollar volume, you may encounter problems with your Hawaii customers that are paying Use Tax on your imported services in the 4%+ amount, and are not inclined to pay you an additional 4%+ recapture unless you demonstrate you are subject to GE.

Finally, least significantly, adding on the 4%+ recapture and not registering filing may put you in a difficult position under a doctrine known as “estoppel” should you later have to respond to an audit by the Hawaii Department of Taxation.

A Potential Solution: Addressing The Problem With Contractual Language

A service provider might consider contractually addressing the general excise tax in its contract with Hawaii businesses. In general, a Hawaii entity hiring (or retaining) you and familiar with your scope of services will assign responsibility for all taxes, including general excise taxes, upon you, in its contract. Stated another way, most Hawaii businesses understand this GE problem and will assign responsibility for it to you, the naïve out-of-state service provider.

In general, non-Hawaii businesses and service providers do not understand the complete ramifications of this clause, because of the lack of familiarity with the general excise tax and its reach.

Note, if you have or develop physical nexus, this contractual language is nothing more than a clarification of the actual legal situation.

Returning to our operative no-physical-nexus scenario, under the law, a Hawaii entity importing services should be paying Use Tax on the imported services for a provider without nexus. [1] [Professionally, I am skeptical on overall compliance with Use Tax requirements.]

There is an additional asymmetry of information: a Hawaii entity could well know whether its out-of-state provider would or would probably have physical or economic nexus: for example, via a site visit or installation visit.[2]

For economic nexus, this could be simpler due to the economic threshold, indeed, depending on the services, the Hawaii customer might actually be in a position to control or influence economic nexus in a calendar year. Whether an invoice was generated and/or paid in December or January could make a significant difference.

Once there is nexus, economic or physical, the out-of-state provider is liable for GET, and the Hawaii resident is not obligated for Use Tax. See, General Excise Tax Instructions (Rev. 2018), p 4, “Examples of Property, Services, or Contracting That You Do Not Report,” [“Property, services, or contracting purchased from a seller who was subject to the GET upon a sale or transfer of the property, services or contracting to the user.”]

In my thoughts, it is possible to contractually resolve the general excise/use tax issue in the face of uncertainty. Practically, this would work better with few customers and relatively larger amounts.

The starting point is that, prior to physical or economic nexus being established, the Hawaii customer is paying Use Tax for imported services. Upon nexus being established, the Hawaii customer is eligible to seek a Use Tax refund for that year, and, independently of the refund being retained, remit the GE balance to the out-of-state vendor, who presumably would have registered for and obtained an GE license. From that point forward, GE plus recapture would be imposed on all invoices.

Thus, an appropriate contractual clause might include:

require the Hawaii customer to pay to the out-of-state provider the recapture amount on all transactions in the calendar year upon notification by the out-of-

[1] As a practical matter, you will not know whether the Hawaii business is paying Use Tax on your imported services.

[2] More cynically, an innocuous lunch meeting to discuss progress or “meet in person” during a vacation.

Depending upon the exact nature of the services and their timing, additional provisions would be in order. The important concept for the out-of-state provider is to avoid an unexpected tax surprise years later.

Conclusion

Economic nexus is likely to cause some unpleasant surprises in the coming years for the reasons outlined above.

For example, a service provider providing services in the $110,000 per year range that fails to register for a license, file returns, and pay GE Tax faces a potential GE/CS annual tax liability of $4,950 plus potentially two 25% penalties and statutory interest at 8% per year. Thus, the $4,950 liability could morph (with 25%/50% penalty) into $6,188-$7,425 plus interest at $495-$595 per year.

Service providers providing services used or consumed in Hawaii should seek appropriate professional guidance to avoid unexpected surprises.